What are Price Trading Bands in the Philippine Stock Exchange (PSE)?

A “trading band” is a limit on the price fluctuation of a stock or security. This means there is price control imposed with regard to how much the price can rise or fall on a given trading day.

These price limits are intended to provide investors protection in case prices change drastically — especially if there is no relevant information that should cause dramatic stock price fluctuations.

Trading bands come in two forms: Price Ceiling, or the upper price limit, and Price Floor, or the lower price limit.

Price Ceiling in the PSE

What’s the ceiling price for stocks traded in the Philippine Stock Exchange (PSE)?

The ceiling price is fifty percent (50%) — which means a stock price, compared to its previous closing price, can only increase by up to 50% during a given trading day.

What happens when the ceiling price is hit? Is trading of the stock halted? Nope, trading still continues — people can still buy and sell the stock — but the price can no longer increase beyond the Ceiling Price.

Is it possible for the stock price to fall below ceiling price during trading? Yes, in the PSE, stock prices can move within the price trading bands with the price ceiling as upper limit and price floor as lower limit.

Price Floor in the PSE

What about the price floor? The price floor, or lower price limit, in the PSE is thirty percent (30%).

This means a stock price can only fall by as much as 30% on a given trading day.

As mentioned earlier, this price limit helps protect investors because, technically speaking, an investor can only lose up to 30% on a stock every trading day. Imagine if there’s no price floor. An investor can practically have his or her capital wiped out in a day if there is no floor price limit.

Let’s see examples of how Price Ceiling and Price Floor are applied in the PSE.

Examples of Price Ceiling in the PSE

Price ceilings are typically seen in cases of successful Initial Public Offerings or IPOs in the PSE.

On November 2, 2021, AllDay Marts Inc. (stock code: ALLDY) traded in the PSE for the first time and closed at its ceiling price of P0.90 per share.

The P0.90 closing price is a 50% increase — thus, hitting the price ceiling — over its IPO price of P0.60.

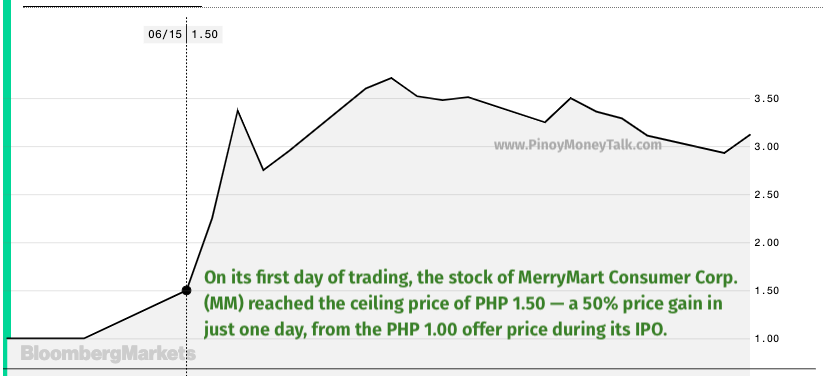

ALLDY’s ceiling mirrored the price performance of another supermarket chain which IPO’d in 2020. On June 15, 2020, MerryMart Consumer Corp. (stock code: MM) zoomed to its price ceiling of P1.50 on MM’s first trading day — a 50% rise over its P1.00 IPO price.

On April 7, 2014, Double Dragon Properties (stock code: DD) also closed at the ceiling on its first trading day after the IPO. DD’s stock closed at P3.00 — a 50% increase from its P2.00 IPO offer price.

Examples of Price Floor in the PSE

The floor price limit in the PSE is 30%, which means a stock price cannot fall below 30% on any given trading day.

For example, given ALLDY’s initial price of P0.60 per share, its price floor is P0.42 — computed as (P0.60 * 0.70) or, alternatively, (P0.60 -(P0.60*.30)).

This means the trading band that day for ALLDY is P0.42 as the floor price (lower limit) and P0.90 as the ceiling price (upper limit).

Let’s take a look at another example. Let’s assume that the stock price of PLDT – Philippine Long Distance Telephone Company (stock code: TEL) during the previous trading day was P1,642.00.

In the next trading day, given the 30% price floor, TEL’s price can only decrease by as much as 30%. Specifically, the lowest price TEL can supposedly go is P1,149.40 — computed as (P1,642.00 * 0.70) or, alternatively, (P1,642.00-(P1,642.00*.30)).

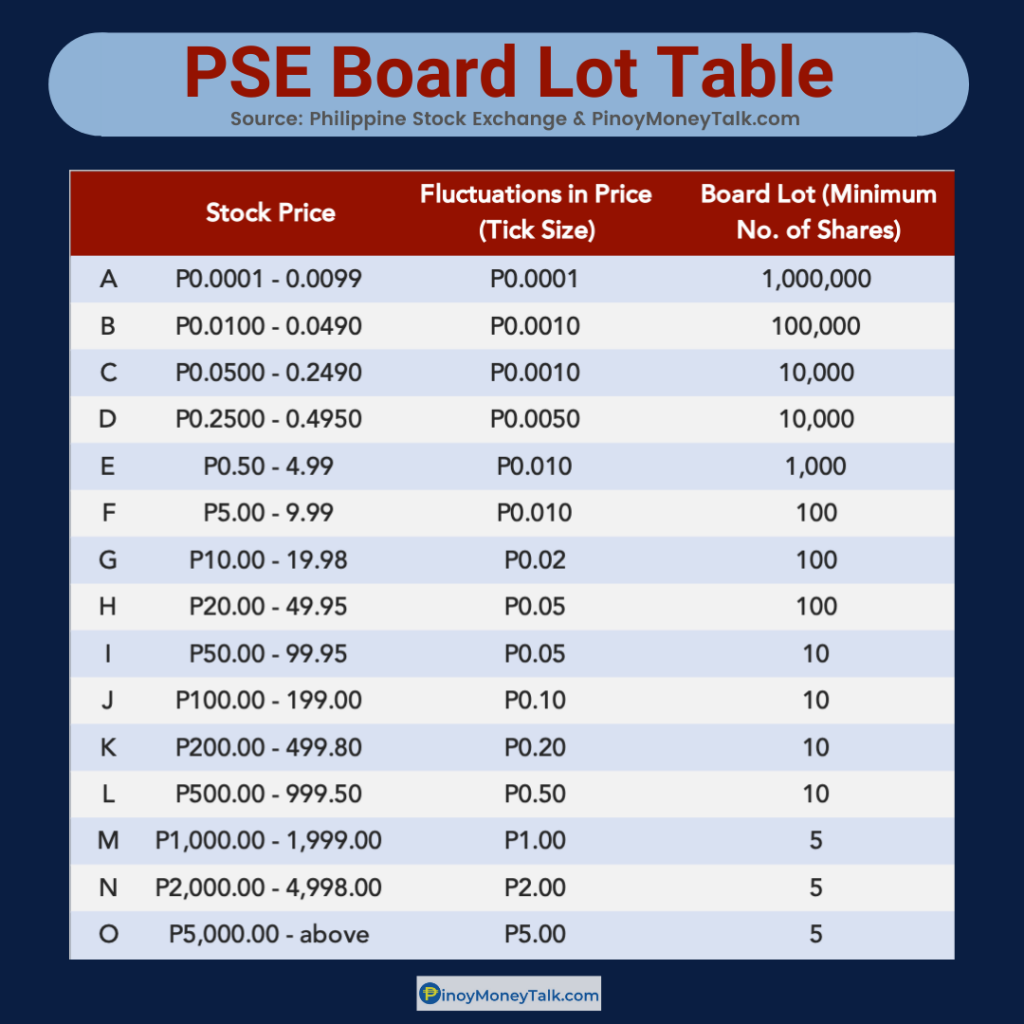

But take note, the ceiling and floor prices we computed may be slightly different from what we’ll see in the PSE since prices are still dictated by the PSE Board Lot table.

PSE Board Lot and Price Floor and Ceiling

How does the Board Lot table impact the price floor and price ceiling? Let’s look at an example.

Let’s assume PLDT closed at P1,415.00 on the previous trading day. In today’s trading, according to the PSE Board Lot table (Row M in the figure below), its price can only fluctuate by a minimum of P1.00.

Thus TEL’s floor price of P1,149.40 must be rounded up to the nearest P1.00 to become a “valid” stock price. The actual floor price, then, of TEL during that trading day is P1,150.00.

Why round up to P1,150.00 and not round down to P1,149.00?

If TEL’s price falls to P1,149.00, then this price is already a decrease of 30.02% from the P1,642.00 previous closing price — a violation of the 30% ceiling price rule of the PSE.

Now that you know these price trading bands, we hope you’re on your way to becoming a smart investor. Happy trading!