How much do you need to start trading stocks on the Philippine Stock Exchange (PSE)?

How many shares of Globe Telecom (GLO), Ayala REIT Inc. (AREIT), DITO CME Holdings (DITO), or Megaworld (MEG) can you buy or sell at any given time?

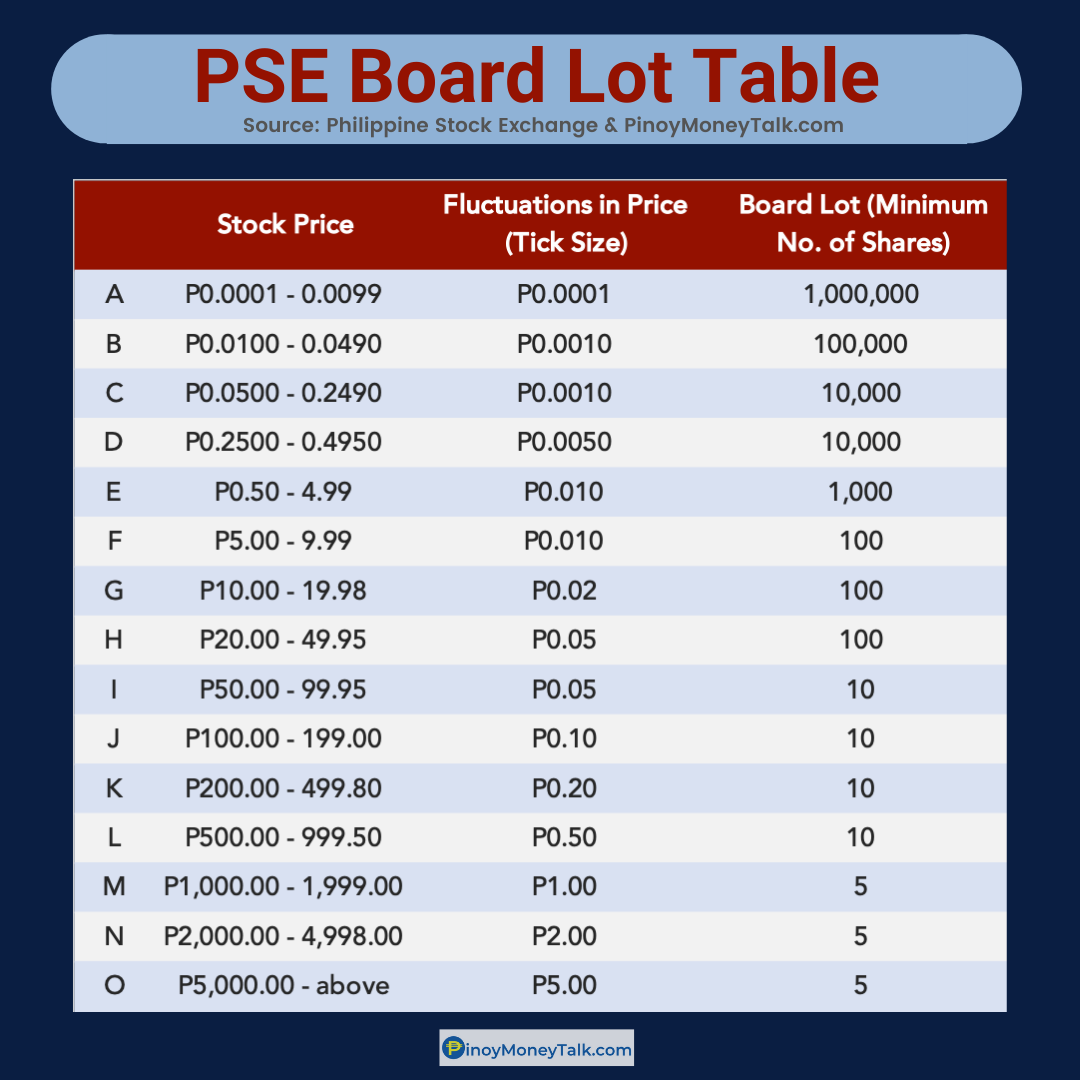

You may not know it, but these questions can be answered by using the PSE Board Lot Table.

Check out these other useful resources on stock trading:

- The Emotional Cycle of Investing: Why People Lose Money in Stocks

- PSE Stocks Performance under each Philippine President (from 1987 to 2021)

- PSE Trading Hours: What time open, when closed?

- My stock got delisted, what should I do?

- Stock Tips and Recommendations — FREE!

What is the PSE Board Lot Table?

The Board Lot Table of the Philippine Stock Exchange (PSE) is a guide for investors that indicates the:

- Minimum number of shares that can be bought or sold at any given time; and

- Minimum price increments for each stock traded on the PSE.

Here’s what the PSE Board Lot Table looks like.

How to Read the PSE Board Lot Table

| Stock Price | Fluctuations in Price (Tick Size) | Board Lot (Minimum No. of Shares) | |

|---|---|---|---|

| A | P0.0001 - 0.0099 | P0.0001 | 1,000,000 |

| B | P0.0100 - 0.0490 | P0.0010 | 100,000 |

| C | P0.0500 - 0.2490 | P0.0010 | 10,000 |

| D | P0.2500 - 0.4950 | P0.0050 | 10,000 |

| E | P0.50 - 4.99 | P0.010 | 1,000 |

| F | P5.00 - 9.99 | P0.010 | 100 |

| G | P10.00 - 19.98 | P0.02 | 100 |

| H | P20.00 - 49.95 | P0.05 | 100 |

| I | P50.00 - 99.95 | P0.05 | 10 |

| J | P100.00 - 199.00 | P0.10 | 10 |

| K | P200.00 - 499.80 | P0.20 | 10 |

| L | P500.00 - 999.50 | P0.50 | 10 |

| M | P1,000.00 - 1,999.00 | P1.00 | 5 |

| N | P2,000.00 - 4,998.00 | P2.00 | 5 |

| O | P5,000.00 - above | P5.00 | 5 |

1. The Stock Price Column

The “Stock Price” column shows the range of prices for a PSE stock. Depending on a stock’s current price, this column indicates the corresponding row that details the allowed price fluctuations (called the “tick size”) and the minimum number of shares that can be bought or sold (called the “board lot”).

So for a stock trading at P3.00 per share, refer to Row E (P0.50-P4.99) to find the relevant tick size and board lot..

2. The Fluctuations in Price (Tick Size) Column

The “Fluctuations in Price” or “Tick Size” column shows the allowed price change for a given stock. For instance, in Row E, where the tick size is P0.010, a stock can only move in increments of P0.010.

Similarly, a stock trading at P5,100.00 can only move in increments of P5.00, as indicated in the “Tick Size” column for Row O (P5,000 and above).

This means the stock can trade at P5,105.00, P5,345.00, or P4,855.00 — since these values are divisible by P5.00. However, it cannot trade at P5,103.00, P5,501.25, or P6,557.00, as these figures are not divisible by the required tick size of P5.00.

3. The Board Lot (Lot Size) Column

Finally, the “Board Lot” or “Lot Size” represents the minimum number of shares that can be traded on the PSE depending on the stock’s current price.

For example, Row E specifies that stocks within this price range must have a board lot of 1,000 shares, meaning, you can only buy or sell shares in multiples of 1,000. This means you’re allowed to trade 2,000 shares, 5,000 shares, or even 30,000 shares of such stock.

We’ll see a clearer application of the Board Lot Table in the practical examples below.

The “Odd Lot” Market

For now, just take note that the Board Lot Table only applies to “Normal Lot” trades in the PSE, which differ from trades in the “Odd Lot” market.

An odd lot refers to a number of shares less than the standard trading unit (or board lot) as identified in the Board Lot Table.

Pop quiz! What’s the board lot for a stock currently trading at P2.00 per share?

(Refer to the Board Lot Table to answer the question. Continue reading if you want to know the answer already.)

This falls under Row E in the Board Lot Table, which indicates that the minimum lot size is 1,000. Any quantity of shares that is not a multiple of 1,000 is considered an odd lot.

As you can see in the sample Odd Lot order below for Megaworld Corporation (MEG), both the Bid Volume (Bid Vol) and Ask Volume (Ask Vol) are in quantities not divisible by 1,000 — such as 250, 900, 999, 1,900, etc.

Odd lot orders typically have slightly different prices compared to Normal Lot orders. The number of orders (and consequently, fulfilled trades) is often lower since fewer traders use the Odd Lot Market.

Don’t worry, though — most of the time, you’ll be trading “normally,” so for now, you only need to focus on understanding the “Normal Lot” version of the PSE Board Lot table.

3 Uses of the PSE Board Lot Table

The PSE Board Lot Table serves three key purposes:

(1) Determining the minimum number of shares that can be traded for each stock.

(2) Identifying the minimum price fluctuation or increment applicable to each stock.

(3) Calculating the minimum amount of money required to buy any PSE-traded stock.

Let’s explore three examples that demonstrate how to use the PSE Board Lot Table to determine these aspects.

1. Minimum number of stocks to buy (or sell) in the PSE

To determine the minimum number of shares that can be bought or sold, follow these steps:

Step 1: Get the current price of the stock. Let’s say you want to know the minimum number of shares of Globe Telecom (GLO) that you can buy or sell. Check the PSE website or your broker’s website to get GLO’s current price. Let’s assume GLO is currently trading at P2,200.00.

Step 2: Locate the corresponding row in the PSE Board Lot Table. GLO’s stock price of P2,200.00 corresponds to “Row N”, which covers the price range of P2,000.00 to P4,998.00.

Step 3: Find the Board Lot (Lot Size) column in this row.. The lot size shows the minimum number of shares that can be traded. In the case of GLO, the lot size is 5. This means you are allowed to buy or sell shares in multiples of 5.

Can you sell 50 shares? Yes!

The lot size is a minimum, so you can sell any multiple of 5. The number of shares traded can be higher than five (5) as long as that number is divisible by 5.

Can you sell two (2) shares of GLO? No. (However, take note, you can trade such quantities in the Odd Lot market.)

Can you buy 115 shares of GLO? Yes, because 115 is divisible by 5.

Easy, right? Now let’s explore the other application of the Board Lot table.

2. Allowed stock price changes in the PSE

Let’s say you previously bought shares of SM Prime Holdings (SMPH) and now you want to sell them now to lock in the profit. The stock currently trades at P36.15 per share. Can you sell your shares at P36.48? How about at P37.25?

To determine the allowed price increment or price change for any give PSE-traded stock, use the Board Lot Table and refer to the Fluctuations in Price or Tick Size column. Follow these steps:

Step 1: Find the current price of the stock. Just like in our earlier example, you can check the PSE website or your broker’s website to get the current price of a stock. In the case of SMPH, let’s assume its current stock price is P36.15.

Step 2: Locate the corresponding row in the PSE Board Lot Table. If SMPH’s stock price is P36.15, which row in the Board Lot Table corresponds to this price?

If you answered “Row H”, you’re correct. SMPH’s stock price is within the price range of that row (P20.00 to P49.95), so we will use this row in Step 3.

Step 3: Identify the Minimum Price Fluctuation (Tick Size) for this row. The “Tick Size” column indicates the smallest allowed price change for the stock.

“Row H” tells us that the required tick size is PHP 0.05. This means that the allowed price increments must be multiples of 0.05.

So, going back to our question earlier: can you sell SMPH at a price of P36.48?

No, because P36.48 is not divisible by 0.05.

Can you sell it at P37.25? Yes! Since this price is divisible by 0.05.

But take note, whether your order will be a done trade depends on the presence of buyers willing to purchase SMPH shares at your asking price.

Understanding the Board Lot Table is helpful especially when placing a Limit Order, where you specify your desired buying or selling price for the stock.

3. How much money needed to invest in the PSE

How much money do you need to buy stocks in the PSE?

Actually, there is no fixed minimum amount required to start investing in the PSE. The amount needed depends on the price of the stock and the minimum lot size for that stock.

Of course, to open a stock trading account, your broker may require a certain amount as initial deposit. But once your account is set up, the minimum amount needed to start trading stocks will depend on the price of the stock you wish to buy.

Let’s see an example below.

Let’s say you want to determine how much you’ll need for your first trade — buying the minimum number of shares of Megaworld Corp. (MEG). Follow the steps below to calculate the amount needed:

Step 1: Get the current price of the stock. Again, simply check the PSE website or your broker’s website to get the current price of your stock. In the case of MEG, let’s assume its current price is P3.35.

Step 2: Determine the lot size from the PSE Board Lot table. Refer to the process outlined in our earlier examples to find this information.

Checking MEG (with an assumed stock price of P3.35) in the Board Lot Table, we find that its minimum lot size is 1,000 shares, as indicated in “Row E”. We’ll use this information in the next step.

Step 3: Multiply the current price by the minimum lot size. This gives you the minimum amount of cash required to buy the stock.

For MEG, the calculation is: P3.35 (current price) × 1,000 (minimum shares) = P3,350. Therefore, you need P3,350 to purchase the minimum number of MEG shares.

Indeed, the PSE Board Lot Table is a valuable tool for calculating the minimum investment needed to start trading.

Wait, there’s more!

Take note that stockbrokers like COL Financial, GStocks, BPI Trade, PhilStocks, First Metro Securities, etc. charge trading fees and commissions, which will increase your total cost.

To understand these fees and how they affect your investment, read our article on PSE Stock Trading Fees and Charges (with Sample Computations). This guide will help you calculate the total amount required for buying stocks and the cash proceeds you’ll receive from selling them.

Congratulations! You now know how to use the PSE Board Lot Table. Happy investing!

Check out these other useful resources on stock trading:

- The Emotional Cycle of Investing: Why People Lose Money in Stocks

- PSE Stocks Performance under each Philippine President (from 1987 to 2021)

- PSE Trading Hours: What time open, when closed?

- My stock got delisted, what should I do?

- Stock Tips and Recommendations — FREE!