Did you know that Philippine stocks were able to achieve an astounding growth of 800% in a span of 30 years?

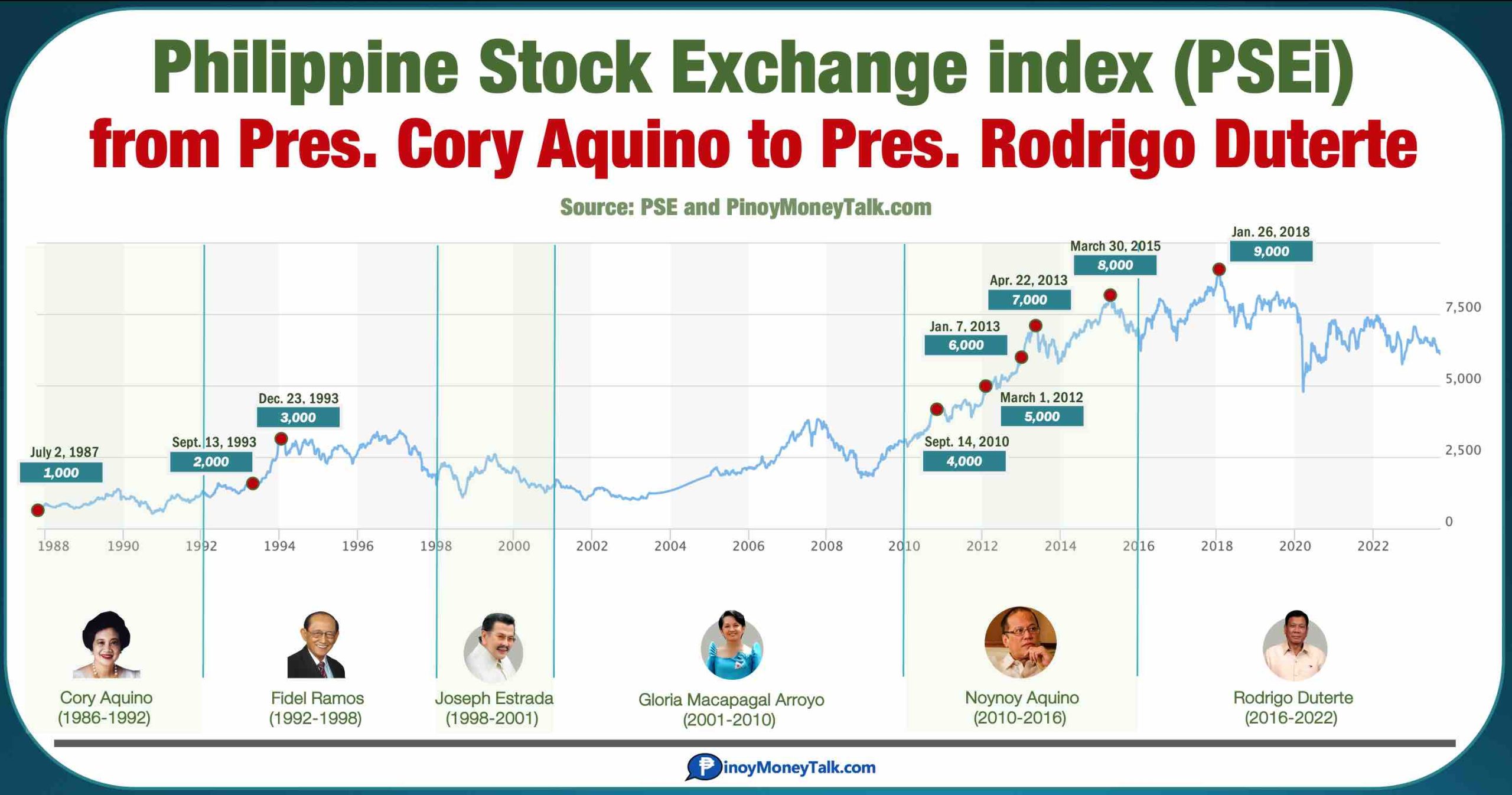

From 1987 until 2018, the Philippine Stock Exchange index (PSEi) rose from 1,000 points to a peak of 9,000 points — generating a return of 800% over 30 years.

(Note: The PSEi is an index comprised of 30 companies listed in the Philippine Stock Exchange (PSE) and is normally considered a barometer of the Philippine economy.)

This performance generally means if you invested P100,000 in the PSEi back in 1987 and just left it there for 30 years, this money would be worth close to a million pesos in 2018!

From a mere 1,000 points in 1987 during the administration of Pres. Cory Aquino, the PSEi grew to its highest level of 9,000 points in 2018 during the term of Pres. Rodrigo Duterte. Unfortunately, though, the momentum faltered starting 2018 and the index is yet to breach the 10,000 level until now.

As of the year 2023, the PSEi is merely hovering above the 6,000 level.

The chart below shows a rundown of when the PSEi achieved the 1,000 round-number breakouts in the last 30 years.

Highest PSEi Level in History is 9,078.37 points

The all-time high level reached by the PSEi was 9,078.37 points — an intra-day achievement recorded on Monday, January 29, 2018.

A week before that, on January 26, 2018 (Friday), Philippine stocks set a historical milestone when it closed at 9,041.20 points, the PSEi’s highest-ever closing price.

Compare that with the level of the index 30 years ago, on July 2, 1987, with the PSEi merely starting at around 1,000 points.

Going from 1,000 to 9,000 points is an 800% increase, so if you invested P100,000 in the PSEi back in 1987 and opted to just leave your money and did nothing afterwards, you’ll be delighted to know that, in 2018, your P100,000 would have been worth more than P900,000. Not bad!

Here are the exact dates of the PSEi’s 1,000-breakout levels and the Philippine President during that time.

PSE Breakout Levels from 1,000 to 9,000

| PSEi Breakout Level | Date first reached | During the term of President |

|---|---|---|

| 1,000 | July 2, 1987 | Cory Aquino |

| 2,000 | September 13, 1993 | Fidel Ramos |

| 3,000 | December 23, 1993 | Fidel Ramos |

| 4,000 | September 14, 2010 | Noynoy Aquino |

| 5,000 | March 1, 2012 | Noynoy Aquino |

| 6,000 | January 7, 2013 | Noynoy Aquino |

| 7,000 | April 22, 2013 | Noynoy Aquino |

| 8,000 | March 30, 2015 | Noynoy Aquino |

| 9,000 | January 26, 2018 | Rodrigo Duterte |

Stocks Performance under each Philippine President

Some interesting facts from the data above:

1. During the time of Pres. Cory Aquino, the first 1,000 breakout level of the PSEi was recorded on July 2, 1987, a little over a year after she assumed the presidency.

2. During the administration of Pres. Fidel Ramos, Philippine stocks achieved two new breakout levels just three months apart. The PSEi’s 2,000-point level was reached on September 13, 1993 while the 3,000-point level was reached on December 23, 1993.

3. During the administrations of Pres. Joseph “Erap” Estrada and Pres. Gloria Macapagal Arroyo (GMA), the PSE never reached any new 1,000-point milestone.

The sluggish performance of the Philippine stock market was partly due to market meltdowns resulting from the aftermath of the Asian financial crisis in 1997 (during Pres. Estrada’s term) and the subprime mortgage and global economic crisis in 2007 (during Pres. GMA’s term). Both major events effected a heavy toll on Philippine stocks lasting almost two decades.

4. It took the PSEi a long 17 years, from 1993 to 2010, to increase by a mere 1,000 points from 3,000 to 4,000 level.

5. While it took the PSEi 17 years to go from 3,000 to 4,000, it only took less than two years to jump from 4,000 to 5,000 points. This happened during the administration of Pres. Noynoy Aquino when the local index grew from 4,000 in September 2010 to 5,000 in March 2012.

6. During the administration of Pres. Noynoy Aquino, the PSEi doubled its value from 4,000 to 8,000 points. Philippine stocks also managed to breach the 1,000-point hurdle five (5) times during his term — the 4,000 level in 2010, 5,000 level in 2012, 6,000 and 7,000 levels in 2013, and the 8,000 level in 2015.

7. It took the local stock market index three years (from March 2015 to January 2018) to reach a brand-new milestone from 8,000 to 9,000 points. The 9,000-point level was reached on January 26, 2018, almost two years into the administration of Pres. Rodrigo Duterte.

8. In 2020, Philippine stocks plummeted alongside global markets because of the COVID-19 pandemic. The PSE suffered its biggest one-day decline of -13.34% on March 19, 2020 following the national government’s announcement of lockdowns and mobility restrictions throughout the country.

PSEi Closing Prices every year (from 2001 to 2022)

The table below lists down the closing prices of the Philippine Stock Exchange index (PSEi) at the last trading day of the year from 2001 until 2022.

| Year | Year-end Closing Price | PSEi 1-Year Return |

|---|---|---|

| 2022 | 6,566.39 | -7.80% |

| 2021 | 7,122.63 | -0.24% |

| 2020 | 7,139.71 | -8.64% |

| 2019 | 7,815.26 | 4.68% |

| 2018 | 7,466.02 | -12.76% |

| 2017 | 8,558.42 | 25.11% |

| 2016 | 6,840.64 | -1.60% |

| 2015 | 6,952.08 | -3.85% |

| 2014 | 7,230.57 | 22.76% |

| 2013 | 5,889.83 | 1.33% |

| 2012 | 5,812.73 | 32.86% |

| 2011 | 4,374.96 | 4.14% |

| 2010 | 4,201.14 | 37.62% |

| 2009 | 3,052.68 | 63.00% |

| 2008 | 1,872.85 | -48.29% |

| 2007 | 3,621.60 | 21.43% |

| 2006 | 2,982.54 | 42.29% |

| 2005 | 2,096.04 | 14.99% |

| 2004 | 1,822.83 | 26.38% |

| 2003 | 1,442.37 | 41.63% |

| 2002 | 1,018.41 | -12.81% |

| 2001 | 1,168.08 | |

| CAGR (Annual Return) | 9.46% |

Over a 20-year period, Philippine stocks generated an annual return of 9.46%. Simply put, if you invested in the PSEi from 2001 to 2022, you would have earned a return of 9.46% every year.

Definitely not a bad performance, but take note that in order to earn this, you’ll have to ride out all the bull and bear cycles of the stock market in that 20-year period.

CAPM Market Return of Philippine Stocks

If you’re doing an equity research report or stock valuation report, you may use 9.46% as “Expected Market Return (rm)” of Philippine equities which can be plugged into your Capital Asset Pricing Model (CAPM) when using the Discounted Cash Flow (DCF) model.

The market return (rm) in CAPM represents the expected return of the investor from Philippine stocks, represented by the PSEi benchmark index.

Of course, it’s always better to use forecasted market returns (i.e., forward-looking expectations) but if data is unavailable or you don’t feel confident using your forecasted market returns, the historical performance of the stock market index — in this case the PSEi —may be used.

The value of the market return (rm) will vary depending on the time horizon you’re considering. Based on the data above, if you’re to consider 20 years in your equity research report, the expected market return (or rm) of Philippine stocks which you can use in CAPM is 9.46%.

You may use the following table as guide if you plan on using a different time period for your expected market return (rm) of Philippine equities.

| Period | PSE Market Return (Rm) |

|---|---|

| 5 Years | 0.81% |

| 10 Years | 4.99% |

| 15 Years | 5.98% |

| 20 Years | 9.46% |

| 25 Years | 3.29% |

| 30 Years | 6.25% |

After reaching an all-time high of 9,000 points several years ago, where do you think the PSEi is headed now?

With Philippine stocks currently stuck in a rut at the 6,000 level, shall we see a return of the PSEi to 7,000 followed by a breakout beyond 8,000 and 9,000? Or is a collapse below 6,000 and further breakdown to 5,000 the more likely possibility?

Your guess is as good as mine.

Here are other interesting articles you might like:

- How to Waive your Credit Card Annual Fee (BDO, BPI, Metrobank, RCBC, Citibank, UnionBank)

- The Emotional Cycle of Investing: Why People Lose Money in Stocks

- BIR Income Tax Tables in the Philippines and TRAIN Sample Computations

- FREE Stock Tips and Brokers’ Recommendations