The Social Security System (SSS) has finally released the official monthly contribution tables for 2021 which mandate the increase in monthly SSS contribution and changes in the Minimum and Maximum Monthly Salary Credit (MSC) effective January 2021.

The increase in contributions this year is in line with the implementation of Republic Act No. 11199, also known as the Social Security Act of 2018, which was approved into law back in 2018.

Also beginning January 2021, all members with monthly income (more specifically, with Monthly Salary Credit) of at least P20,000 are required to pay the mandatory SSS Provident Fund contribution.

What is the SSS Mandatory Provident Fund?

The SSS mandatory Provident Fund, called WISP or “Workers’ Investment & Savings Program,” is an additional retirement savings plan providing additional monetary benefit to members upon reaching the age of retirement, according to the SSS.

The SSS mandatory Provident Fund is a “defined-contribution plan”, which means the employer and employee make a fixed and known contribution amount every month. The actual amount of benefit to be paid to the SSS member upon retirement, though, is not known in advance.

This is different from a “defined benefit plan” wherein the amount to be received by the member may be identified because the formula to compute the benefit payment is known.

The benefit amount that the SSS member will receive will depend on the performance of the mandatory Provident Fund, with the Fund’s earnings from the management and investment of Provident Fund contributions to be distributed proportionately based on the member’s total Provident Fund contributions.

The SSS mandatory Provident Fund benefits may be paid in lump sum or installment and payable not just due to retirement of the member but also in the case of death or total disability.

The WISP or SSS Provident Fund claims will be processed simultaneously and automatically with regular SSS benefits once the member or his/her beneficiaries have submitted a claim application.

How much is the SSS mandatory Provident Fund contribution?

Starting January 2021, all employed SSS members with monthly salary credit of at least P24,750 will need to contribute P650.00 to the mandatory SSS Provident Fund. This amount is to be shared by the employee and employer, with the employee paying P225.00 and the employer paying P425.00 every month.

Employed members with MSC below P24,750, meanwhile, will pay a lower Provident Fund contribution. See the tables below for the actual amounts.

This rule also applies to Household employees and Kasambahays. The employer shoulders P425.00 while the kasambahay pays P225.00, for a total of P650.00 contribution, again with the assumption that the kasambahay’s monthly salary credit is at least P24,750.00.

Self-employed members earning a salary credit of at least P24,750 per month will have to pay the P650.00 contribution to the mandatory SSS Provident Fund all on their own since they do not have an employer.

This rule is the same for Voluntary Members, Non-Working Spouses, and all land-based OFWs — they will have to pay the full monthly contribution to the SSS mandatory Provident Fund on their own.

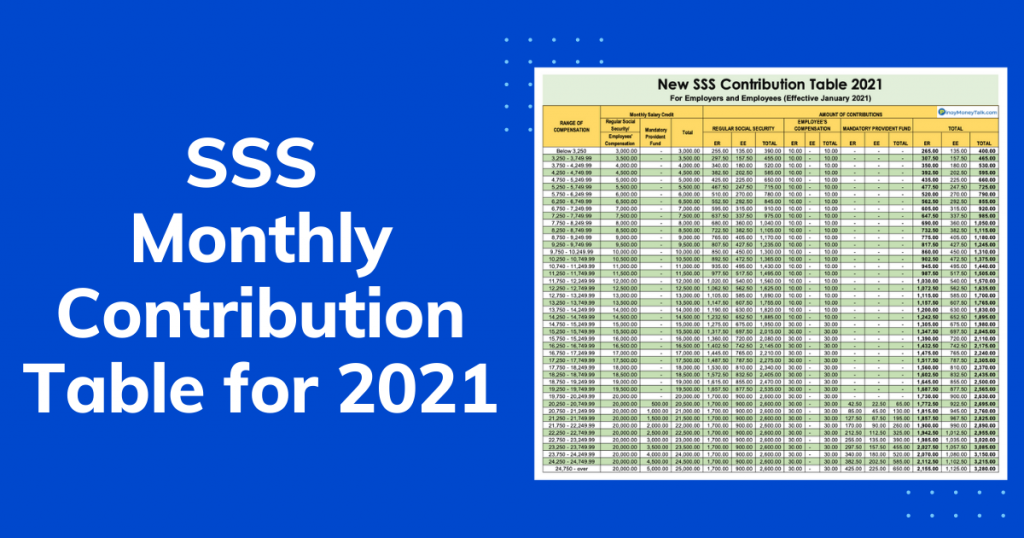

SSS Contribution Table (2021) for Employees and Employers

You may download here a bigger and higher resolution copy of SSS Contribution Table in 2021 for Employees and Employers.

Below is a copy of the official memo from SSS containing the revised schedule of SSS contributions applicable to employers and employees (from SSS Circular 2020-033-b).

SSS Contribution Table (2021) for Self-Employed

You may download here a bigger and higher resolution copy of SSS Contribution Table in 2021 for Self-Employed members.

Here’s a copy of SSS Circular 2020-034-b which contains the official schedule of regular Social Security, Employees’ Compensation, and Mandatory Provident Fund contributions applicable to self-employed members.

SSS Monthly Contribution Table (2021) for Voluntary Members and Non-Working Spouse

You may download here a bigger and higher resolution copy of SSS Contribution Table in 2021 for Voluntary Members (VM) and Non-Working Spouse.

Below is a the official memo from SSS Circular 2020-035-b with the revised SSS contribution tables applicable to Voluntary Members (VM) and Non-Working Spouse members.

SSS Monthly Contribution Table (2021) for Land-based OFWs

You may download here a bigger and higher resolution copy of SSS Contribution Table in 2021 for Land-based OFWs.

Here’s a copy of the official SSS memo containing the new schedule of regular Social Security and Mandatory Provident Fund contributions applicable to land-based OFW members (from SSS Circular 2020-039).

SSS Monthly Contribution Schedule (2021) for Kasambahay and Household Employers

You may download here a bigger and higher resolution copy of SSS Contribution Table in 2021 for Kasambahay and Household Employers.

Below you’ll find a copy of the official SSS memo containing the revised schedule of regular Social Security, Employees’ Compensation, and Mandatory Provident Fund contributions applicable to Household Employers and Kasambahay members (from SSS Circular 2020-036).

How to Compute SSS Contribution

Knowing how to use the SSS contribution table can help you better understand if the monthly SSS premium deducted from your salary is correct.

To know this, you must be able to properly identify the following information from the rows and columns in the SSS contribution ntables.

1. Range of Compensation. This is the category where your monthly salary belongs.

For example, if you’re an EMPLOYEE receiving P20,000 monthly salary, your “Range of Compensation” is P19,750 – 20,249.99 from the SSS Monthly Contribution Schedule for Employees and Employers.

If you’re an OFW receiving salary of P100,000 per month, your “Range of Compensation” is the last row in the SSS Monthly Contribution Schedule for Land-based OFWs, representing the maximum Monthly Salary Credit.

2. Social Security – EE. This is the “Employee contribution” (in the column “SS Contribution-EE”); basically the amount of your personal SSS contribution as an employEE (thus, “EE”).

3. Social Security – ER. This is the column “SS Contribution-ER”, the counterpart contribution of your employER (thus,”ER”).

4. EC Contribution. This represents contributions for the “Employees’ Compensation” (EC) Program which is a fund for work-connected injury, sickness, disability and death with cash income benefit, medical, rehabilitation and related services. The EC contribution is solely paid by the employer, except for Self-Employed which is paid by the self-employed member.

5. Mandatory Provident Fund. Beginning January 2021, all SSS members receiving monthly compensation of at least P20,000 are required to pay the mandatory Provident Fund contribution.

The mandatory SSS Provident Fund — specifically the “Workers’ Investment & Savings Program” or WISP — is similar in nature to a regular retirement savings plan. According to SSS, this will provide additional monetary benefit to SSS members upon reaching the age of retirement. As such, withdrawal of Provident Fund contributions is not allowed, unless the member has retired or has died.

6. Total Contribution (Total). This shows the full amount of your SSS contribution, combining both your personal contributions and your employer’s counterpart payment, if applicable.

Now to properly compute your monthly SSS contribution, follow these step-by-step instructions.

Step 1. Compute “Actual Remuneration”

Take note that as per the SSS Citizen’s Charter, the term “compensation” refers to “actual remuneration for employment, including the mandated cost of living allowance, as well as the cash value of any remuneration paid in any medium other than cash except that part of the remuneration received during the month in excess of the maximum salary credit as provided in the SS Law.”

This simply means that the “actual remuneration” received by the employee, and NOT the stated gross or basic monthly compensation, is going to be used as basis when computing the SSS contribution.

A clear application of how the SSS contribution will change, depending on the actual compensation received by the employee, is shown in Example 2 below in the section “Sample Computations of SSS Contributions”.

Step 2. Check “Range of Compensation”

With the actual remuneration verified, the next step is to refer to the applicable SSS Contribution Table depending on the membership type.

Under the “Range of Compensation” column in the applicable SSS contribution schedule, look for the row where your gross monthly salary or actual remuneration falls under.

For example, if you’re an Employee of a company in the Philippines with gross monthly salary of P15,000.00, the relevant row is the compensation range “P14,750 – P15,249.99” in the “SSS Contribution Table for Employees and Employers”.

If you’re an OFW receiving gross monthly compensation of P200,000, the relevant row is the compensation range “P24,750-Over” in the “SSS Contribution Table for Land-based OFWs”.

Step 3. Pay corresponding “Total Contribution”

I. For salaried employees, the amount of the EmployER share and EmployEE share can be seen in the “Total Contribution” columns.

The Employer pays the amount in the “Total Contribution – ER” column, while the Employee pays the amount in the “Total Contribution – EE” column. The amount to be remitted to SSS by the employer is the sum of the two, and can be seen in the “Total Contribution – Total” column.

So in the case of an Employee earning P15,000 salary per month, the Employer Share is P1,305.00 while the Employee Share is P675.00 based on the SSS Contribution Table for Employees and Employers.

This means, the employee will be deducted the amount of P675.00 from his or her monthly salary, while the employer must remit to SSS the full contribution of P1,980.00 (computed as P1,305.00 + P675.00).

II. For Self-Employed (SE), Voluntary Member (VM), or Non-Working Spouse (NWS), the only relevant column is the “Total Contribution” column. There is no Employer share since they are either not working or working but with no other employer but themselves. In this case, they will be the one to shoulder the entire contribution.

So if you’re a Voluntary Member earning gross compensation of P5,000 per month, based on the applicable SSS table, your SS contribution will be P650.00 per month.

Sample Computations of SSS Contributions

Looking for more specific examples of SSS members to better understand how much to deduct as SSS contribution every month? Check out our sample computations below.

1. SSS contribution of Employee earning P24,000 per month

Mr. Suave works as a BPO call center agent in the Philippines. His gross monthly compensation is P24,000. How much will be deducted from his salary as SSS contribution (EE Share)? How much is the Employer share (ER Share)? How much will the employer remit in total to SSS?

Answer: From the “SSS Contribution Table for Employees and Employers”, the relevant range of compensation is the row P23,750 – 24,249.99.

Given no change in compensation that Mr. Suave will receive every month, the Employee Share (EE) is P1,080.00 while the Employer Share (ER) is P2,070.00.

Take note that the Employee Share of P1,080.00 now includes Mr. Suave’s P180.00 monthly contribution to the mandatory SSS Provident Fund.

His employer, in turn, will contribute P340.00 every month to the mandatory SSS Provident Fund.

All in all, the total amount that will be remitted by the employer to SSS is P3,150 every month (Employee share of P1,080.00 plus Employer share of P2,070.00).

2. SSS contribution of Employee with Overtime Pay and Late Deductions

Ms. Minchin is a bank teller receiving P15,000 per month. She received an overtime pay for the month amounting to P1,000 but she was late several times and was penalized late deduction of P500. How much will be remitted to SSS?

Answer: Although Ms. Minchin’s gross basic salary is P15,000, the relevant amount is “actual remuneration or payment” received by the employee, according to the SSS Citizen’s Charter.

The actual remuneration she received was P15,500 (computed as P15,000 plus + P1,000 overtime minus – P500 late deduction). Given remuneration of P15,500, the relevant Compensation Range row is P15,250 – P15,749.99 (NOT the P14,750-P15,249.99 row based on her P15,000 basic salary).

The Employee Share (EE) is P697.50 while the Employer Share (ER) is P1,347.50.

Thus, the total amount to be remitted by the employer to SSS on behalf of Ms. Minchin is P2,045.00.

3. SSS contribution of OFW (sea-based) earning P50,000 per month

Mr. Seaman is a sea-based OFW receiving gross salary of P50,000 per month. How much will he pay as SSS contribution? How much will his employer contribute?

Answer: From the last row in the “SSS contribution schedule for Employees and Employers” (since his salary falls under the row of P24,750-Over), Mr. Seaman will pay the Employee share of P1,125.00, while his employer will be required to pay the Employer share of P2,155.00. The total contribution to be remitted to SSS is P3,280.00.

Who’s the Employer of a seaman worker or a sea-based OFW?

According to the SSS, the “Employer share” shall be paid by the employment agency or manpower agency of Mr. Seaman.

4. SSS premium of OFW (land-based) earning P25,000 per month

Miss DH is a land-based OFW working as a domestic helper in Hong Kong. She receives monthly salary of P25,000 per month. How much will she pay as SSS contribution? How much will her employer contribute?

Answer: According to SSS, Miss DH will be the one responsible to pay both the “employee contribution” and “employer contribution.” In short, her employer will not contribute to her SSS premium payments.

Based on the SSS Contribution Schedule for Land-based OFWs, Miss DH will have to pay the entire SSS contribution of P3,250.00 per month.

5. Kasambahay earning P3,000 per month

Yaya Dub is a kasambahay employed by Mr. Alden. Yaya Dub earns gross salary of P3,000 per month. How much is Yaya Dub’s SSS contribution?

Answer: According to the new SSS law, kasambahays earning less than P5,000 per month are not required to pay the Employee share. Since Yaya Dub’s salary is P3,000 per month, the entire contribution amount of P400.00 shall be paid and remitted to SSS by Mr. Alden, the employer of Yaya Dub. (Relevant “range of compensation” is the row P2,750 – P3,249.99.)

6. Kasambahay earning P21,000 per month

Because of her competence, Yaya Dub was given a huge salary increase by her employer Mr. Alden. Yaya Dub now receives a gross monthly salary of P21,000. How much will her SSS contribution be this time?

Answer: From the SSS Contribution Table for Kasambahay and Household Employers, the relevant range of compensation is P20,750–21,249.99.

Yaya Dub is now responsible for paying the Employee share of the SSS contribution. Her total Employee share is P922.50 which includes P22.50 mandatory Provident Fund contribution.

Meanwhile, her employer Mr. Alden will pay the Employer share of P1,772.50 which also includes P42.50 mandatory Provident Fund contribution.

Thus, the total amount to be remitted to SSS as total contribution by Yaya Dub is P2,695.00 per month.

Who will pay SSS Employer Contribution of Kasambahay, Self-Employed, Non-Working Spouse?

For self-employed, non-working spouse, and voluntary members, since they do not have any employer, they will be the ones responsible for paying the entire SS contribution.

For kasambahay who is earning less than P5,000 per month, the full SSS contribution will be shouldered by the employer. If the kasambahay is earning more than P5,000 per month, he/she will have a share in the total contribution. The employer still gets to pay more and the distribution of premiums is shown in the contribution table below.

For non-working spouse, they will also be the one to pay the contribution in full, but the basis of contribution will be 50% of the Monthly Salary Credit (MSC) of the working spouse.

Who will pay SSS Employer Share of OFWs?

Under the new SSS charter, sea-based OFWs (such as seamen or ship crew) are considered “regular employed” members. Their SSS contributions will therefore be collected and remitted to the SSS by their manning or employment agencies which are considered agents, and thus employers of the sea-based OFW.

Land-based OFWs, meanwhile, are currently considered “self-employed” members since current labor agreements do not allow for the same set-up as that of sea-based OFWs. As such, land-based OWs will be solely required to pay the SSS contribution in full prior to leaving for abroad.

This means, they themselves will need to shoulder the “Employer Share” of the SSS contribution. In short, there is no “employer contribution” for land-based OFWs.

Can OFW leave for abroad without paying SSS contribution?

The newly approved SSS law (RA 11199) provides for mandatory coverage for all OFW — meaning, all Overseas Filipino Workers are now required to pay monthly SSS contributions depending on the salary they are receiving.

Based on the Implementing Rules and Regulations (IRR), an OFW will not be allowed to leave the country unless he or she has paid the required contribution. Thus, payment of full SSS contributions is now a pre-requisite before an OFW can leave to work abroad.

New Monthly Salary Credit (MSC) in 2021

The Monthly Salary Credit in SSS refers to the “compensation base for contributions and benefits related to the total earnings for the month.”

Under the new SSS law, the highest Monthly Salary Credit or MSC for the year 2021 is P25,000 — up from the previous maximum MSC of P20,000 in 2020 — which means the member’s premium contribution will now be based on this P25,000 MSC.

The MSC is important because this becomes the basis, not just for the amount of SSS contribution that the member has to pay, but also for the computation of benefits that SSS members may receive.

As explained by former SSS Commissioner Emmanuel Dooc in a Philippine Star interview: “As we increase the coverable income, the benefits also increase because this is the basis for computation of SSS benefits.”

Under the IRR of the new SSS law, the contribution rate and Monthly Salary Credit (MSC) will increase effective January every year from 2019 to 2025.

The SSS monthly contribution rate will rise from 12% of the MSC in 2019 and 2020 then to 13% in 2021 and 2022 then to 14% in 2023 and 2024 and finally to 15% of the MSC by the year 2025. The maximum Monthly Salary Credit will also rise, from P20,000 in 2019 to P35,000 in 2025.

Changes in the SSS contribution rate and MSC from 2021 to 2025 are shown in the table below.

New SSS Contribution Rate and Monthly Salary Credit (MSC)

| Year | Contribution Rate | Employer Share | Employee Share | Minimum MSC | Maximum MSC |

| 2021 | 13% | 8.5% | 4.5% | P3,000 | P25,000 |

| 2022 | 13% | 8.5% | 4.5% | P3,000 | P25,000 |

| 2023 | 14% | 9.5% | 4.5% | P4,000 | P30,000 |

| 2024 | 14% | 9.5% | 4.5% | P4,000 | P30,000 |

| 2025 | 15% | 10% | 5% | P5,000 | P35,000 |

Effective January 2021, Employed, Self-Employed, Voluntary Member (VM), and Non-Working Spouse members of SSS will have a new minimum Monthly Salary Credit (MSC) of P3,000, while the new maximum MSC is P25,000.

For Household Employers and Kasambahay members, the minimum Monthly Salary Credit is still P1,000 but the maximum MSC is now P25,000.

For Land-based OFW members, the minimum Monthly Salary Credit is still P8,000 while the maximum MSC has been increased to P25,000.

Why SSS contributions increased

According to the SSS management, the recent increase in monthly SSS contributions is expected to help reduce the pension fund’s unfunded liability.

“Unfunded liabilities” are future obligations of the SSS in which no funds have been set aside.

Back in 2014, the SSS could only cover obligations and liabilities up to year 2039. This meant that after 2039, the SSS would have been unable to provide pension and benefits anymore to its members.

However, in 2017, Pres. Rodrigo Duterte approved a proposal to increase the monthly pension received by SSS retirees by P2,000 per month. The first additional P1,000 monthly pension increase was paid beginning 2018 and the next P1,000 increase was paid beginning 2019.

This move, although benefited more than 2.3 million SSS pensioners, cut short the life of SSS by more than ten (10) years. Because of the increase in pension, the life of the SSS shortened to year 2026, meaning, by 2026 the SSS would likely be unable to pay obligations and members might no longer receive monthly pension from SSS.

Thus, according to SSS, the additional increase in monthly contribution was necessary in a bid to prolong the life of SSS. The approval of the Social Security Act of 2018 extended the life the fund until the year 2045, “on the back of the implementation of the contribution increase and adjustment in minimum and maximum salary credits under the newly-signed law.”

We just hope the SSS management will be prudent and competent enough to manage these funds from this point onwards. Otherwise, the happy retirement of millions of Filipinos banking on the SSS will be put at risk.